As the global shipping industry is only just recovering from years of fluctuating demand, geopolitical tensions, and unpredictable fuel costs, a scene has just unfolded in China that will long be remembered in the history of the global shipbuilding industry. China COSCO Shipping Corporation—the largest Chinese shipping and logistics giant—and China State Shipbuilding Corporation (CSSC)—the largest shipbuilding group in the world—have signed a contract that can hardly be described as anything other than epochal.

87 ships. Nearly 50 billion yuan. The largest order in the history of cooperation between these two giants.

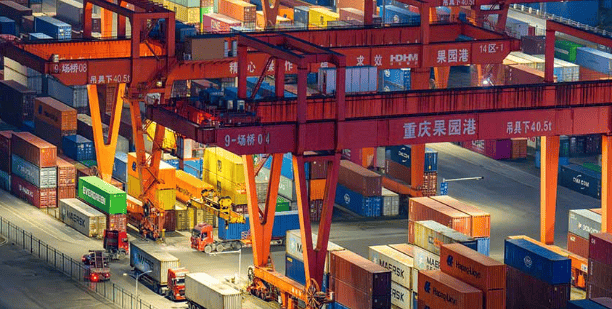

A Chinese demonstration of capabilities

In a world where technological advantage is often determined in laboratories, and industrial advantage in quiet negotiation rooms, Beijing has decided to remind everyone of one thing: in the shipbuilding sector, China still sets the pace.

This contract is not an ordinary order. It is a demonstration of the full value chain—from design to assembly—and a declaration that domestic giants can operate with a scale that others can only envy.

Under the agreement, COSCO will receive a wide range of vessels: from massive container ships and bulk carriers to tankers, ro-ro ships, ro-pax vessels, and modern units adapted for alternative fuels. Each type addresses a different market segment as well as various global trends—and that is the strength of this contract. This is not a purchase for a year or two. It is an investment in a decade of dominance.

A quiet revolution: green technologies and geopolitics

It is no coincidence that the order comes at a time when shipping is facing a decarbonization revolution. IMO regulations and the EU’s Fit for 55 package are accelerating modernization for shipowners. COSCO, as a global player and a key component of China’s industrial policy, must stay ahead of competitors—and that is exactly what it is doing.

The new vessels will be adapted for low-emission fuels, while CSSC is steadily developing dual-fuel technology and designs ready for future fuels: methanol, ammonia, or e-fuels. This is not only a response to regulatory requirements—it is a strategic hedge against sudden energy market shifts that could destabilize less-prepared shipowners.

Thus, the contract also has a geopolitical dimension. It gives Beijing a tool to maintain further control over the global supply chain—which is now more politicized than ever. While Europe and the U.S. are trying to shorten supply chains and diversify suppliers, China is doubling down on industries where it is already the leader.

For CSSC—a golden era. For competitors—a cold shower

From CSSC’s perspective, the contract guarantees several years of a full order book and certainty that production will operate at full capacity. This is stability rarely seen in the shipbuilding sector, which usually experiences cycles of boom and bust.

For competitors—especially in South Korea and Japan—it signals that to maintain their position, they will need to invest not only in technology but also in production capacity. China’s cost advantage and strong state support make attempts to compete “on volume” almost doomed to fail. Competitors are left with specialized niches: LNG, high-tech offshore units, and military market constructions.

The shipping market watches closely

Although the contract has generated excitement, questions arise. Does the world really need so much new tonnage? Could overcapacity in a few years lead to freight rate declines? Will rising steel and equipment costs eat into shipyards’ margins?

One thing is certain: an order like this does not go unnoticed. Industry and financial observers are already wondering whether other major shipowners will follow COSCO’s lead. The market tends to imitate giants—and if one of the largest players makes multi-billion purchases, the signal is clear: a new investment cycle has begun.

What does this contract say about the future of global shipping?

Contrary to appearances, this is not just about ships. It is about who will control the transport of goods, energy, and raw materials—the foundation of the modern economy. COSCO and CSSC have just played a card that strengthens their position both economically and politically.

This is a forward-looking move. A testament to ambition. A signature of an era in which state-owned giants dare to shape global trends rather than just react to them.

Because one thing is more certain today than ever: China has no intention of relinquishing its leadership in the global shipbuilding industry. On the contrary—they are just getting started.