Port of Gdynia saw an impressive increase in general cargo handling, including containers, in the first quarter of 2025 – general cargo up by 16.6%, containers (in TEU) up by 26.5%, despite a 2.6% decline in total tonnage.

The Port of Gdynia started 2025 with a marked increase in a key cargo group. In the first quarter, general cargo throughput rose by 16.6% year-on-year, while container throughput (in TEU) increased by 26.5%. In March alone, growth was even stronger: 21.2% and 39.5% respectively compared to March 2024. Total cargo tonnage reached 6.31 million tonnes, down 2.6% year-on-year – mainly due to lower volumes of coal and grain, which are returning to pre-surge trends after the extraordinary increases of the past two years.

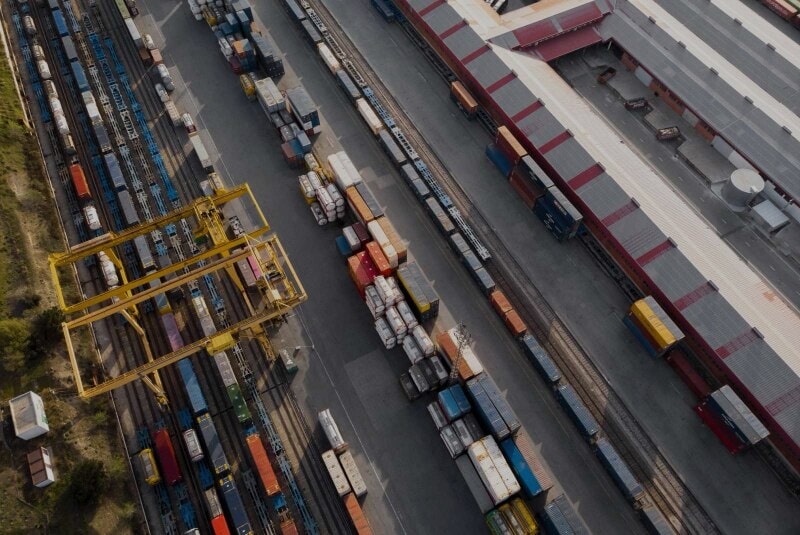

General cargo remains the largest cargo group – 4.28 million tonnes in the first quarter not only represents the highest share but also growth across all its segments. Ferry and ro-ro handling increased by 8.07% in Q1, and by nearly 16% year-on-year in March.

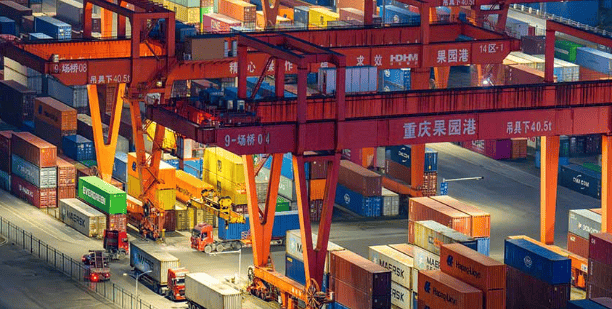

Containers also saw a record-breaking start to the year. The 278,432 TEU handled in the first quarter was more than a quarter higher than the same period last year. Tonnage-wise, container throughput also rose by 22.5%. In March alone, container throughput increased by 39.5% year-on-year. This strong performance was partly due to the development of new shipping services – including the launch of Lakeway Link (2024), MSC’s Britannia service (2025), and Gemini Cooperation (2025). It is worth noting that throughput increased despite ongoing infrastructure works – March marked the completion of the first phase of modernization, including the Helskie Quay.

In the grain segment, throughput fell by 33.7%, and in coal and coke by 32.4%. These raw materials had seen intensive handling at the port between 2022 and 2024, due to geopolitical events and supply chain disruptions. Now, their volumes are returning to pre-war levels. A decline was also recorded in the oil and petroleum products group – down 15%.

“We’re witnessing a structural shift: less bulk cargo, more general cargo, including containers – the kind that requires more precision and higher-quality infrastructure. This confirms that the direction we’ve taken aligns with real market needs,” said Adam Hoppe, Director of the Office for Strategy and Market Analysis.

Growth in general cargo and containers is not only the result of changes in global supply chains but also a sign of growing trust in the Port of Gdynia as an efficient transport hub capable of handling high-value, time-sensitive cargo. New connections, service development, infrastructure investments, and operational readiness – all contribute to a tangible competitive edge.

Port Gdynia is building its position as a universal, yet specialized port – one that can respond flexibly to market changes while offering its partners predictability, efficiency, and high service quality. The first-quarter 2025 growth signals that the market recognizes these strengths and is increasingly choosing Gdynia as a destination port.

Let me know if you’d like this formatted differently or need a shorter summary!