Intermodal Transport Statistics in Q4 2024 Summarize the Year’s Performance in This Sector

The intermodal transport statistics for the fourth quarter of 2024 provided a summary of the sector’s performance over the past year. And it was a good year—every indicator in intermodal transport increased compared to the previous year. In some cases, the values achieved were even higher than those recorded in earlier years.

The mass of goods transported in intermodal freight increased year-on-year by nearly 3.2 million tons—from just under 24.5 million tons to over 27.6 million tons. This represented a 13% increase. Transport performance (measured in tonne-kilometers) in intermodal freight rose in 2024 by over 0.9 billion tonne-kilometers, reaching a total of 9.4 billion tonne-kilometers (a 10.7% increase). In 2024, the number of intermodal transport units also grew—from 1.59 million to 1.74 million units (an increase of over 152,000 units, or 9.6%). Regarding the number of TEUs transported, there was a rise from 2.43 million TEUs in 2023 to 2.72 million TEUs in 2024 (an increase of 11.6%).

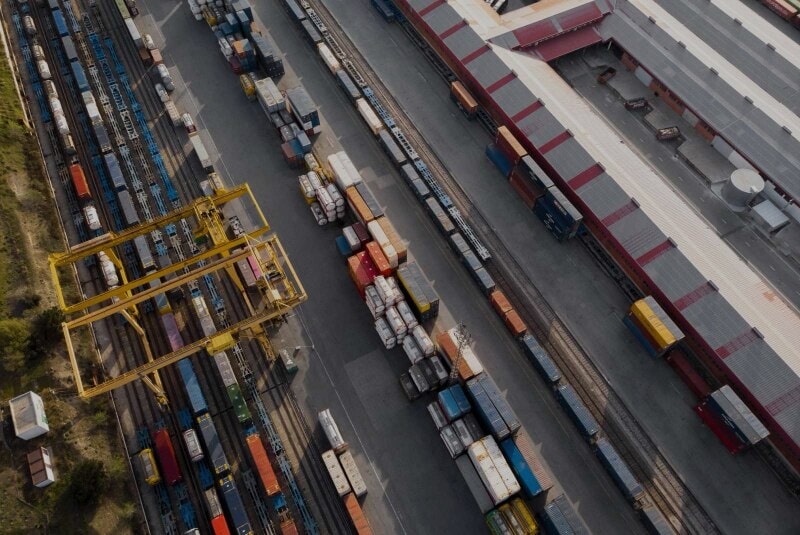

After a year like 2023, which was highly sensitive to economic fluctuations and saw a slowdown in intermodal transport, 2024 brought more stability. Economic and geopolitical developments had a lesser impact on the execution of container transport. There was also noticeable interest in the rail intermodal transport market, as reflected in the number of operators reporting this type of transport (39 companies).

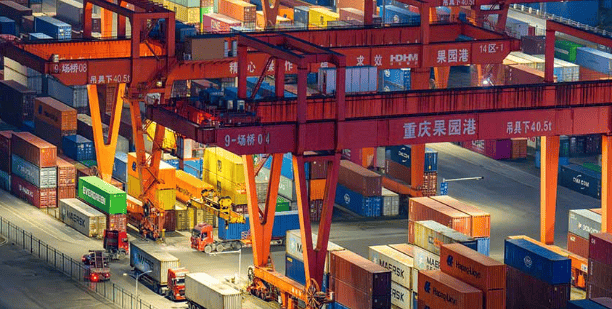

Despite an uncertain international situation, transport along the New Silk Road via the Brest–Terespol Poland–Belarus border crossing increased in 2024 compared to 2023. For a long period, results were close to the record levels of 2021, though towards the end of 2024, transport volumes declined due to stricter Russian regulations. Meanwhile, new routes to Ukraine continued to be developed. These factors, along with record-breaking port transshipment results, influenced the performance of intermodal freight using rail.

“Intermodal transport is now a very important branch of rail freight. Its share of total freight mass stands at 12.4%, and 16.1% in terms of transport performance—these are the highest values since the Office of Rail Transport began collecting intermodal transport statistics. This confirms its growing significance. Therefore, new support schemes for intermodal transport have been introduced, such as an additional intermodal relief and EU-funded investment programs for this sector,” commented Dr. Eng. Ignacy Góra, President of the Office of Rail Transport.

In each of the first three quarters of 2024, intermodal transport indicators showed year-on-year growth compared to 2023. In the fourth quarter, the only parameter that declined compared to 2023 was transport performance, which dropped by 3.4%. In particular, the data for Q2 and Q3 showed much higher values than in 2023.

In Q4 2024, 438,600 intermodal units were transported, which translated into 690,300 TEUs. In terms of mass and transport performance, this amounted to 6.83 million tons and 2.34 billion tonne-kilometers, respectively. Compared to Q4 2023, these figures represent a 3.9% increase in the number of intermodal units (16,528 units), an 8.4% increase in TEUs (53,442 TEUs), a 1.7% increase in cargo mass (114,200 tons), and a 3.4% decrease in transport performance (0.08 billion tonne-kilometers). Compared to Q3 2024, the Q4 results were slightly lower—down 3.4% in units, 2% in TEUs, 3.7% in mass, and 1.9% in transport performance (-15,594 units, -14,375 TEUs, -0.3 million tons, and -0.04 billion tonne-kilometers).

In the fourth quarter of 2024, intermodal freight was reported by 36 operators, while for the full year, there were 39 such companies.

The largest market share in intermodal transport in 2024 based on transport performance was recorded by PCC Intermodal S.A. (19.55%). Other companies exceeding a 5% market share included: PKP CARGO S.A. (18.7%), DB Cargo Polska S.A. (14.11%), Captrain Polska Sp. z o.o. (5.6%), and Metrans Rail Sp. z o.o. (5.58%).

Based on cargo mass, the largest market share belonged to PCC Intermodal S.A. (17.45%), followed by PKP CARGO S.A. (16.49%), DB Cargo Polska S.A. (12.67%), Captrain Polska Sp. z o.o. (6.35%), Metrans Rail Sp. z o.o. (5.89%), LTE Polska Sp. z o.o. (5.75%), and Eurasian Railway Carrier Sp. z o.o. (5.67%).

Detailed results for each quarter, along with historical data, are available in the Intermodal Transport section on the Railway Data website.

You can also view the full report Intermodal Transport in 2024 on the UTK website.